|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

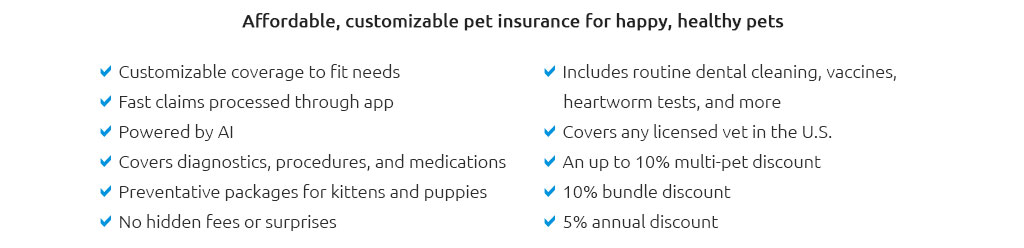

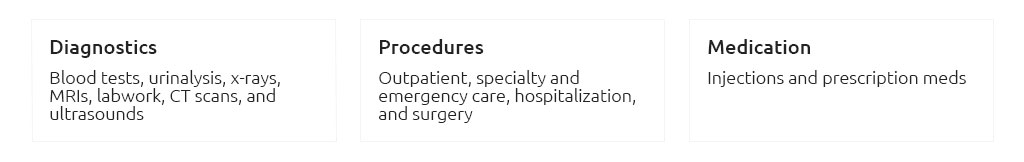

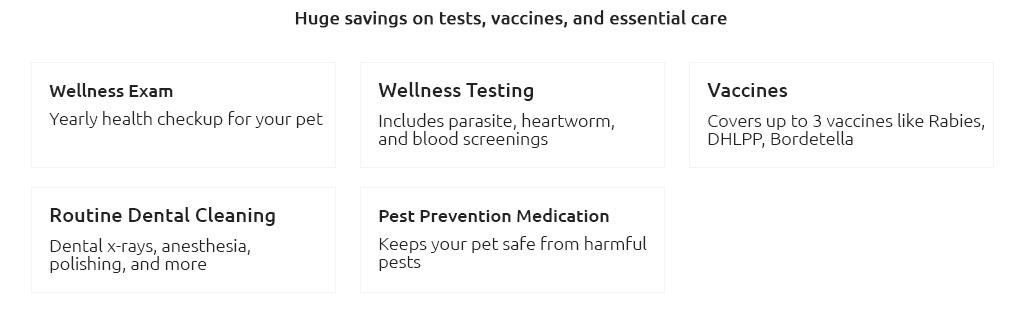

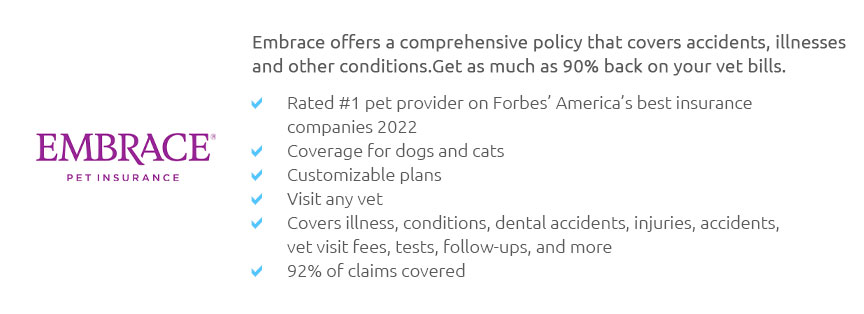

Exploring the World of Pet Insurance: A Comprehensive Guide to Choosing the Right Plan for Your Furry FriendIn the ever-evolving landscape of pet ownership, ensuring the well-being of our beloved furry companions has become a paramount concern, and one of the most effective ways to safeguard their health is by investing in pet insurance. As a devoted pet owner, you undoubtedly want the best for your animal friend, which is why understanding the nuances of various pet insurance options can be pivotal in making an informed decision. In this article, we delve into the intricacies of pet insurance, offering a detailed comparison of popular plans available in the market today, to aid you in navigating this essential aspect of pet care. First and foremost, it is crucial to recognize that pet insurance is not a one-size-fits-all solution. Each plan is designed with specific needs and budgets in mind, catering to a diverse array of pet owners. To begin with, let's consider the basic types of coverage. Generally, pet insurance plans can be broken down into three categories: accident-only policies, accident and illness policies, and comprehensive plans that cover wellness visits and preventive care. Accident-only plans are often the most affordable, focusing primarily on unexpected incidents such as fractures, ingesting foreign objects, or other unforeseen injuries. While these policies can be a cost-effective way to ensure peace of mind, they lack coverage for illnesses, which might be a significant consideration depending on your pet's age and health condition. On the other hand, accident and illness plans offer broader protection, encompassing both sudden injuries and ailments ranging from minor infections to chronic conditions. These plans strike a balance between cost and coverage, making them a popular choice among pet owners seeking comprehensive protection without breaking the bank. Finally, comprehensive plans, often considered the gold standard of pet insurance, provide the most extensive coverage, including routine check-ups, vaccinations, and dental care. While they come with a higher price tag, the peace of mind they offer by covering a vast array of potential veterinary expenses is unmatched. When comparing pet insurance options, it's essential to evaluate not only the type of coverage but also the specifics of each plan, such as deductible amounts, reimbursement levels, and annual coverage limits. A higher deductible might reduce your monthly premium but could result in higher out-of-pocket costs when filing a claim. Similarly, understanding the reimbursement percentage-commonly ranging from 70% to 90%-can help you gauge how much of your veterinary expenses will be covered by the insurance provider. Reputable companies such as Healthy Paws, Embrace, and Trupanion have established themselves as leaders in the pet insurance industry, each offering unique plans tailored to various needs.

In conclusion, selecting the right pet insurance involves a careful assessment of your pet's health needs, your financial capacity, and a thorough comparison of available plans. While the plethora of options might seem daunting at first, taking the time to research and understand the intricacies of each policy will ultimately lead to a more confident and informed decision, ensuring that your cherished companion receives the best possible care throughout their life. Remember, the peace of mind that comes with knowing your pet is protected is invaluable, making pet insurance a wise investment in their health and happiness. https://www.petinsurancequotes.com/

Find the best pet insurance for dogs and cats. Compare coverage, cost, wellness plans, and more from top insurers. Get a free quote for your pet today. https://www.pawlicy.com/

Pawlicy Advisor provides free quotes, comparison charts, and help from licensed agents to get you the best pet insurance for your breed at the lowest rate. https://www.libertymutual.com/pet-insurance

Pet insurance to protect them like family. We offer multiple policy options covering illnesses, injuries, and wellness. Plus get up to 90% back on vet ...

|